Proving Performance.

Building Belief.

Portfolio management software delivering evidence-based insight and confidence between MGAs and their capacity providers.

How can Sybil Help you?

MGA Perspective

Secure your capacity and strengthen carrier confidence

Result: predictable renewal, faster capacity replacement, and long-term growth

Carrier Perspective

Transparent illumination of performance and activity, reducing uncertainty

Result: a stable revenue stream at predictable margins — built on evidence

Two sides of the same coin

Sybil connects MGAs and carriers through transparent, evidence-based portfolio management

Don’t just present your performance, prove it

Don’t just take their word for it: test it, believe it

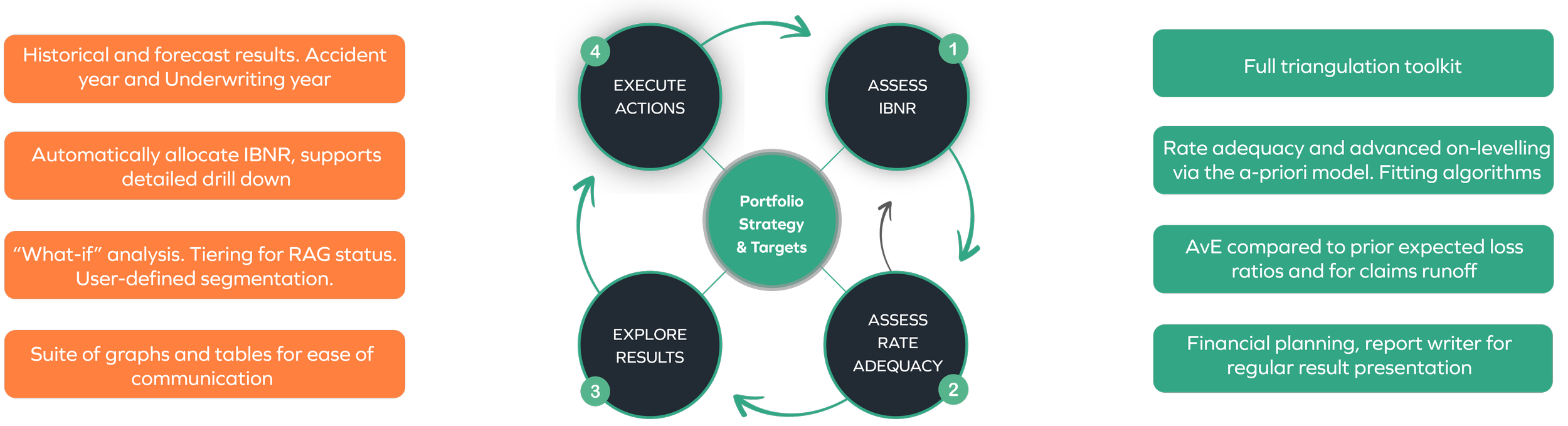

What about active management?

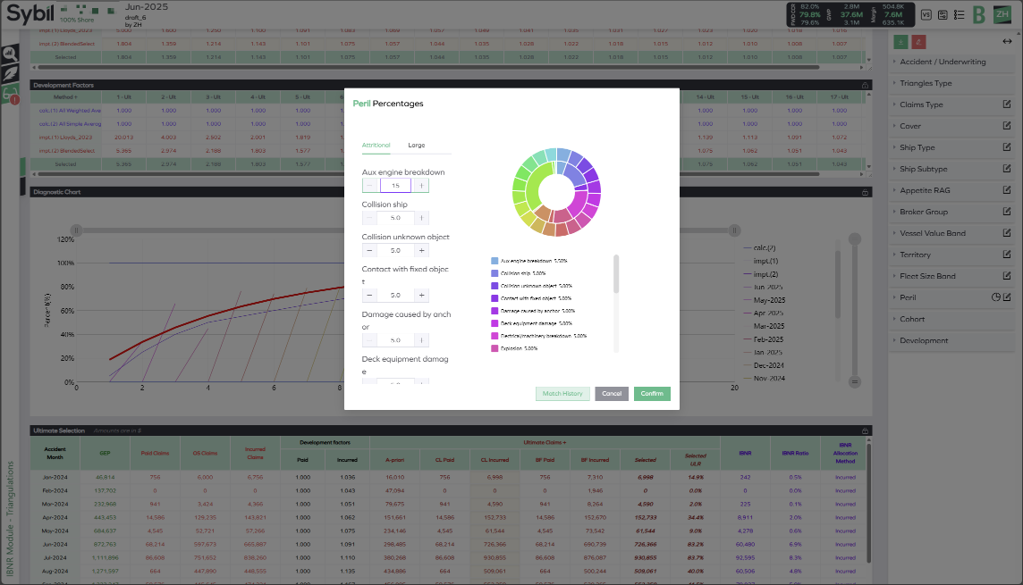

Prove it with IBNR (credible loss-ratio history)

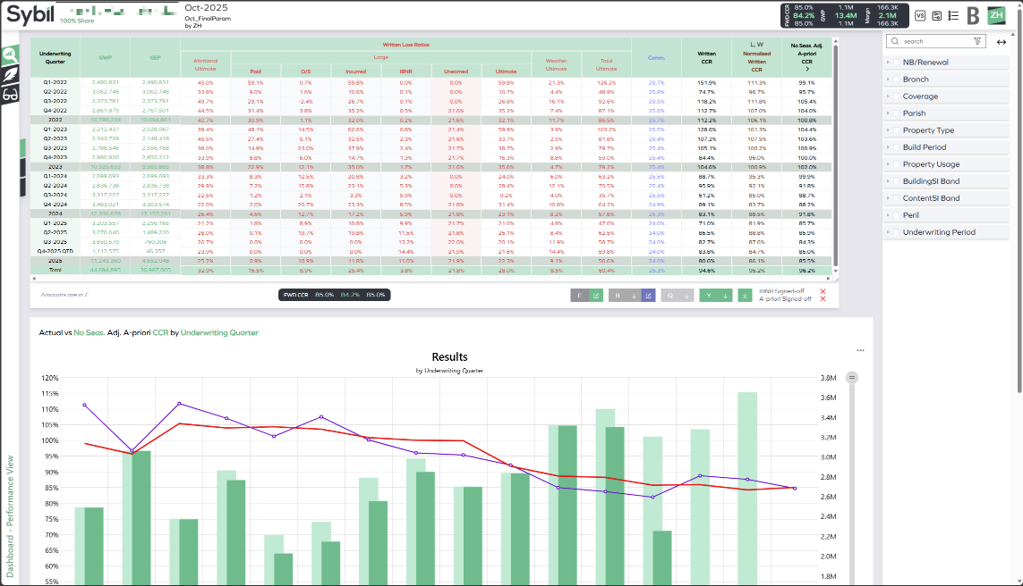

Prove it with forecast results (credible rate adequacy)

Prove it month by month and quarter by quarter

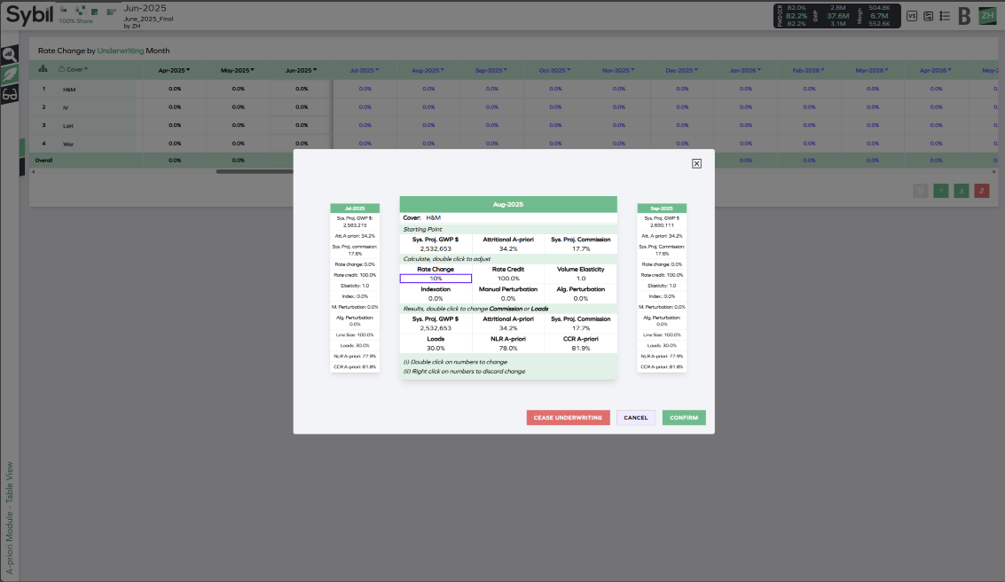

Prove it segment by segment and show active management

Prove improvement actions will hit targets

Prove your proposed “what-ifs” make sense

Prove you can still deliver under stress-testing

What about active management?

Believe the IBNR (credible loss-ratio history) estimates

Believe the MGA’s assessment of rate adequacy

Test belief by repeating monthly and quarterly (10× efficiency with Sybil)

Systematic, software-led review with detail impossible to achieve manually

Transparency shows where improvement is needed

Challenge the MGA with “what-if” questions

Stress-test assumptions to justify confidence

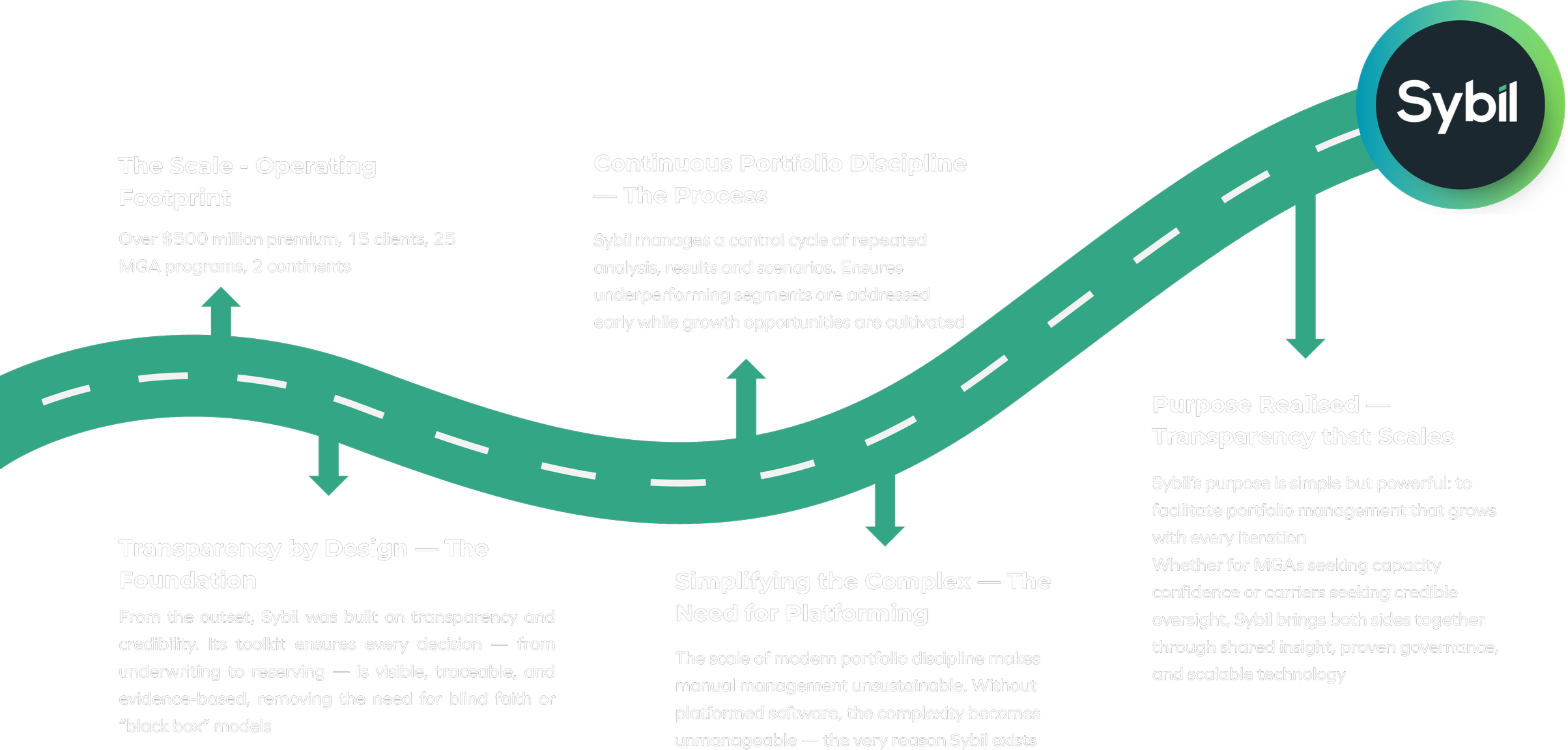

Proven Scale. Clear Purpose

Exploring results

From Insight To Actions

Analysis

“Sybil connects analytics, action, and assurance — one platform, one process, one truth”

Underwriter Q&A

Q: Do I want assured, enduring profit from existing portfolios?

Q: Do I want strong MI harnessing all actuarial insights?

Þ You need a portfolio management process

Q: Can I get a “single version of the truth” from actuaries?

Q: Can I link actions to strategic objectives?

Q: Can I explore the portfolio in drill-down detail ?

Þ You need portfolio management with Sybil

Actuary Q&A

Q: Do I want to bring together pricing and reserving insights to aid portfolio performance?

Q: Do I want to organise and manage my team’s work efficiently, including “what if” studies?

Þ You need a portfolio management process

Q: Can our work be seen to influence performance directly?

Q: Can I liberate resources from process-management to explore emerging challenges and opportunities?

Q: Can I liberate resources from maintaining platformed systems?

Q: Can I manage the boring-but-important things like allocations and model updates more efficiently?

Þ You need portfolio management with Sybil

CFO Q&A

Q: Do I want efficiency in my analytical operations?

Q: Can I link actuarial outputs to my financial planning process?

Þ You need a portfolio management process

Q: Can I achieve clear combined-ratio improvements without significant investment?

Þ You need portfolio management with Sybil

Ops and IT Q&A

Q: Do I want strategic underwriting decisions to be subject to a definable process?

Q: Do I want to get more out of the data we curate and manage?

Þ You need a portfolio management process

Q: Can I embed the process in a well-platform software tool?

Q: Can the data flows in and out be managed securely with minimal security risk?

Þ You need portfolio management with Sybil